Speak to our Experts: Tele 07919350460

What is critical illness cover and how does it work?

If you fall seriously ill, chances are those wonderful Nurses and Doctors will keep you alive. However, it might take you a while to recuperate. Your bills, including your mortgage repayments will still need to be paid. How about protecting yourself with a cash lump sum, to support you financially, and pay for treatment, whilst you get better?

You can now insure your children against the worst happening - Them suffering from a serious illness. Some insurers will cover them without costing you much extra.

If you are considering purchasing critical illness insurance, compare policies

with our team to find one that meets your family’s needs.

*Please note our services are tailored towards UK residents and domiciled persons.

Speak to our Experts:

What is critical illness cover and how does it work?

If you fall seriously ill, chances are those wonderful Nurses and Doctors will keep you alive. However, it might take you a while to recuperate. Your bills, including your mortgage repayments will still need to be paid. How about protecting yourself with a cash lump sum, to support you financially, and pay for treatment, whilst you get better?

You can now insure your children against the worst happening - Them suffering from a serious illness. Some insurers will cover them without costing you much extra.

If you are considering purchasing critical illness insurance, compare policies

with our team to find one that meets your family’s needs.

*Please note our services are tailored towards UK residents and domiciled persons.

Critical illness cover pays out a tax-free lump sum once you're diagnosed with one of the illnesses or conditions on your policy. You can use your policy to pay for health-related costs, monthly expenses, or lost income while you're getting treatment. If you are diagnosed with any of these illnesses, your critical illness coverage will usually pay out. However, if you contract an illness not included on the list provided, you will not receive compensation.

Like life insurance, critical illness insurance provides a lump sum payout to help deal with the financial consequences of being diagnosed with a serious medical condition.. Unlike life insurance, critical illness covers only specific serious illnesses and does not pay out if you pass away.

You can add life insurance to your existing life insurance policy for a small fee (integrated cover), or purchase it as a separate policy.

You pay a monthly or annual premium for the insurance policy. This amount is included in your life insurance premiums, which you can see on your policy documents.

Critical Illness Cover Options:

You can purchase life insurance and critical illness coverage through us. We offer level-term life insurance with critical illness coverage as a standalone policy, or in combination with level-term life insurance. Critical illness cover is not available to purchase with decreasing-term policies.

Standalone cover policy

Integrated with life insurance

Decreasing term cover

You can either buy standalone critical illness cover or add it to your life insurance policy. When you get a critical illness, the critical illness cover pays out and your life policy continues.

You can buy a combined critical illness policy, often called an integrated policy. A critical illness policy provides a lump sum payment to you or your dependents if you are diagnosed with a critical illness, such as cancer or heart disease. There is only one payout, which means it tends to be more affordable than buying both policies separately.

Decreasing-term life insurance is a type of term life insurance policy that reduces your payout over time as you repay your mortgage or other debts. This type of life insurance tends to be less expensive than level-premium term life policies.

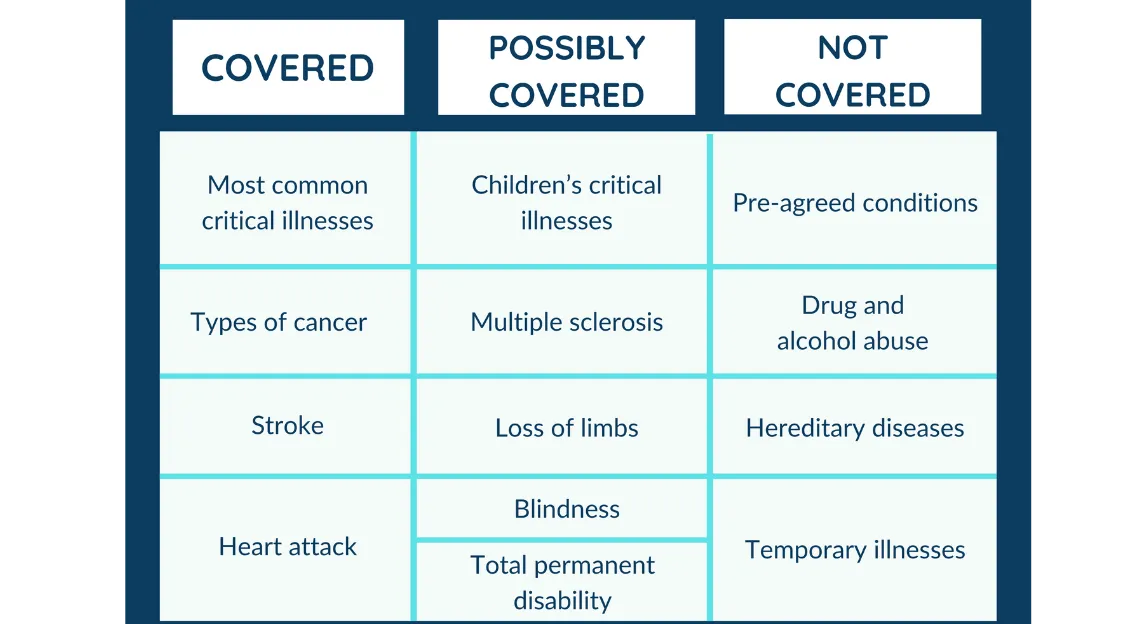

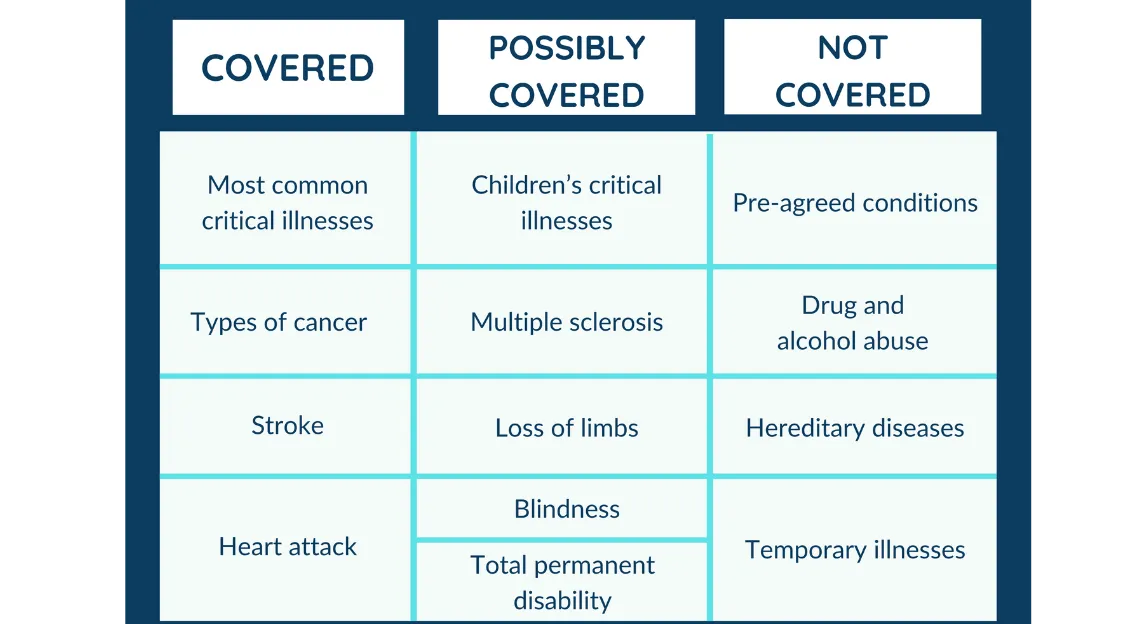

What is covered by your critical illness insurance?

Your critical illness policy will provide financial protection for medical expenses related to children's critical illnesses, cancer, heart attacks, strokes, and other injuries that occur during the policy period. Some policies also cover a range of illnesses, but there are some core conditions that are covered by all policies. And before you buy your critical illness policy, read and understand all of its important documents.

These are the illness that is considered critical:

Each insurer defines its definition of “critical illness,” so it will vary. The contents of the plans will be outlined in policy documents.

Your insurance company will only pay out if the illness you have is severe. Your policy documents should tell you what a "severe" illness is.

The following are covered by critical illness insurance:

Stroke

Heart attack

Advanced cancers or tumors

Organ transplants

Coma

Multiple sclerosis

Dementia and Parkinson’s

Permanent disability caused by illness or an injury

Short-term health insurance policies will cover a broad range of conditions, including some that may not be covered by other types of insurance. But you should expect to pay more for these policies because they tend to be more comprehensive than other types of coverage. You should read the policy documents carefully before you buy coverage so you know exactly what’s covered and how much it costs.

Critical illness cover pays out a tax-free lump sum once you're diagnosed with one of the illnesses or conditions on your policy. You can use your policy to pay for health-related costs, monthly expenses, or lost income while you're getting treatment. If you are diagnosed with any of these illnesses, your critical illness coverage will usually pay out. However, if you contract an illness not included on the list provided, you will not receive compensation.

Like life insurance, critical illness insurance provides a lump sum payout to help deal with the financial consequences of being diagnosed with a serious medical condition.. Unlike life insurance, critical illness covers only specific serious illnesses and does not pay out if you pass away.

You can add life insurance to your existing life insurance policy for a small fee (integrated cover), or purchase it as a separate policy.

You pay a monthly or annual premium for the insurance policy. This amount is included in your life insurance premiums, which you can see on your policy documents.

Critical Illness Cover Options:

You can purchase life insurance and critical illness coverage through us. We offer level-term life insurance with critical illness coverage as a standalone policy, or in combination with level-term life insurance. Critical illness cover is not available to purchase with decreasing-term policies.

Standalone cover policy

You can either buy standalone critical illness cover or add it to your life insurance policy. When you get a critical illness, the critical illness cover pays out and your life policy continues.

Integrated with life insurance

You can buy a combined critical illness policy, often called an integrated policy. A critical illness policy provides a lump sum payment to you or your dependents if you are diagnosed with a critical illness, such as cancer or heart disease. There is only one payout, which means it tends to be more affordable than buying both policies separately.

Decreasing term cover

Decreasing-term life insurance is a type of term life insurance policy that reduces your payout over time as you repay your mortgage or other debts. This type of life insurance tends to be less expensive than level-premium term life policies.

What is covered by your critical illness insurance?

Your critical illness policy will provide financial protection for medical expenses related to children's critical illnesses, cancer, heart attacks, strokes, and other injuries that occur during the policy period. Some policies also cover a range of illnesses, but there are some core conditions that are covered by all policies. And before you buy your critical illness policy, read and understand all of its important documents.

These are the illness that is considered critical:

Each insurer defines its definition of “critical illness,” so it will vary. The contents of the plans will be outlined in policy documents.

Your insurance company will only pay out if the illness you have is severe. Your policy documents should tell you what a "severe" illness is.

The following are covered by critical illness insurance:

Stroke

Heart attack

Advanced cancers or tumors

Organ transplants

Coma

Multiple sclerosis

Dementia and Parkinson’s

Permanent disability caused by illness or an injury

Short-term health insurance policies will cover a broad range of conditions, including some that may not be covered by other types of insurance. But you should expect to pay more for these policies because they tend to be more comprehensive than other types of coverage. You should read the policy documents carefully before you buy coverage so you know exactly what’s covered and how much it costs.

FREQUENTLY ASK QUESTIONS

Critical illness insurance is a form of health insurance that provides a lump-sum payment to cover the costs of a major illness.

Being diagnosed with a serious illness or condition can be life-changing and greatly impact your finances, especially if you need time off work. Critical illness coverage provides financial support during periods of illness or injury that are beyond the control of an individual or family's finances.

Critical illness insurance pays out cash to help cover medical costs when a policyholder suffers from an emergency like a heart attack, stroke, or cancer. These illnesses often incur greater-than-average medical costs, so critical illness policies help cover those overruns when traditional health insurance may fall short.

FREQUENTLY ASK QUESTIONS

Critical illness insurance is a form of health insurance that provides a lump-sum payment to cover the costs of a major illness.

Being diagnosed with a serious illness or condition can be life-changing and greatly impact your finances, especially if you need time off work. Critical illness coverage provides financial support during periods of illness or injury that are beyond the control of an individual or family's finances.

Critical illness insurance pays out cash to help cover medical costs when a policyholder suffers from an emergency like a heart attack, stroke, or cancer. These illnesses often incur greater-than-average medical costs, so critical illness policies help cover those overruns when traditional health insurance may fall short.

Insurance is available for up to 12 years. May I assist you? As specialists in this field, we are happy to guide you through the process of arranging insurance-backed guarantees.

Discover the advantages of an insurance-backed guarantee and how it can provide added security and peace of mind. Learn how these products work and the types of events they cover, as well as the different risks and costs associated with them.

We’ll also help you understand the potential benefits and drawbacks of a particular product, and provide tips and advice on how to choose the best coverage for your needs.

We Work With Companies You Can Trust,

Including

We Work With Companies You Can Trust, Including

Are you covered?

Don't wait until it's too late.

Make sure you and your loved ones are protected with the right insurance.

Simply. Discuss with our team the best solution.

Receive a Quote. Insure your family.

Go about your day knowing we have your family covered.

Are you covered?

Don't wait until it's too late.

Make sure you and your loved ones are protected with the right insurance.

Simply. Discuss with our team the best solution.

Receive a Quote. Insure your family.

Go about your day knowing we have your family covered.

Get A Quote Immediately

Tailored For Your Requirements

Get A Quote Immediately

Tailored For Your Requirements

Office 1, Unit 2B, Bodmin Road, Coventry, CV2 5DB

enquiries@quoteinsurego.co.uk

Mon-Sat 8am to 5pm

Menu

Our Services

Copyright 2022 Powered By SEO Outrank

Office 1, Unit 2B, Bodmin Road, Coventry, CV2 5DB

enquiries@quoteinsurego.co.uk

Mon-Sat 8am to 5pm

Menu

Our Services